Are Extended Warranties Worth It?

This post was originally created on September 21, 2014. It has been updated.

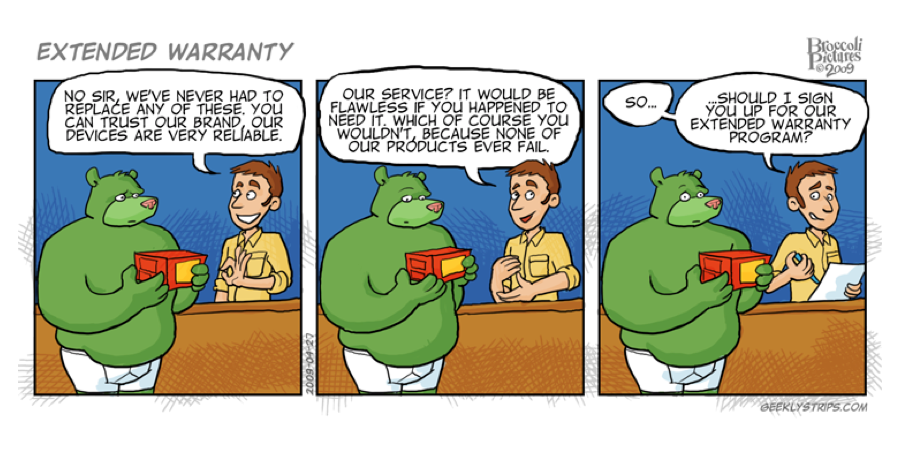

How many times have you been in the checkout line of a store and the dreaded extended warranty question arises? “Do you want to purchase an extended warranty on your…?” I hear it all of the time, especially, when purchasing electronics. So are extended warranties worth it? The simple answer?…it depends… Now I know that wasn’t the answer you were looking for, but let’s look at what extended warranties are in real life. They are small insurance policies. You are spending extra money on the protection of what may or may not happen. Here are some personal things to think about when it comes to extended warranties:

- How many times have you purchased an extended warranty and actually used it? If you did use it, did the warranty pay for itself? If not, how much money could you have saved by not purchasing it?

- Does the warranty have a deductible? Some extended warranties have a deductible that has to be met before the warranty company will pay for the remainder. (Automobile and cell phone extended warranties)

- Is the item you are purchasing actually worth replacing? If the item in question is something that you only may use once, twice, or infrequently, chances are that the extended warranty will expire before you will actually need it. Also, is the item so inexpensive that a warranty is not even cost effective?

- Would you ever sell the item? Many times extended warranties will not transfer to a new owner. Besides, do you want to be bothered by the new owner a couple years down the road when they need your help getting the warranty processed? I am going to assume not.

- Does the warranty cover accidental damages? Most extended warranties will not cover anything beyond normal “wear and tear.”

- Do you have the financial ability to buy the same item again if it was damaged or destroyed? If so, an extended warranty may not even be worth the time or hassle.

Let’s face it. Extended warranty companies offer these “insurance” warranties to make money. Statistically speaking, they have more of a chance to keep your money than paying out for a repair. If not, extended warranty companies would be out of business. So what are some of the ways you could be losing out on buying an extended warranty?

- Not registering your product. Some companies will require you to register the product to actually “activate” your warranty. This goes for standard warranties as well. Have you ever forgotten to fill out that registration card on a piece of electronics you purchased? Guilty here!

- Do you remember where you kept the warranty information on a product from 2 years ago? How about that thermal paper receipt that has faded over time and you can no longer read? Do you even remember where you purchased the item? Is that company even still in business anymore? Circuit City? Montgomery Wards anyone?

- Will you even remember that you purchased an extended warranty? Many times I have forgotten that I even bought an extended warranty.

- Finding out that they no longer make the product thereby wanting to refund the item minus any computer calculated depreciation.

- If you purchase an extended warranty on a vehicle and you sell or trade in said vehicle, you might get little if anything of your premium refunded to you. (Personal experience here)

Who would benefit from an extended warranty? Anyone who is prone to damaging their belongings and cannot afford to replace them. This type of person would benefit from an accidental damage extended warranty. The most common item that comes to my mind that would benefit from this type of warranty would be a cell phone. I think almost everyone has damaged their phone at some point or knows someone who has. Unfortunately, most phone protection plans have a deductible. These deductibles can range anywhere from $0 to $250.00, or more, per incident.

If you enjoy having the peace of mind that may come from purchasing an extended warranty, here are some tips to better your chances when it comes to filing a claim:

- Once you purchase a product with an extended warranty, ensure you fill out any and all applicable paperwork or on-line form to “activate” the warranty.

- Take pictures or scan the warranty card, store receipt, and any other paperwork that you might need to file a claim. Ensure the warranty company’s telephone number and/or website address is listed. Ensure this information is kept in the cloud or somewhere safe in the event that an emergency occurs. Data loss really sucks.

- Keep all warranty and extended warranty paperwork in one place. A filing cabinet would be a good place for the hard copies. You might even want to file the product’s owner’s manual with all the rest of your warranty paperwork.

- Before purchasing an extended warranty, make sure the company is a reputable one. Search on-line for the warranty company’s good and bad reviews. If a company has more bad reviews than good, you might want to steer clear.

- Before spending the extra money on an extended warranty, check with your credit card company. Many credit card companies offer extended warranties automatically on products purchased with their card. You will have to contact your credit card company to see if they offer any type of extended warranty coverage.

In my opinion, extended warranties are a risky gamble. Personally, my luck with gambling isn’t very good, so I usually pass on extended warranties and use my money for the other things I enjoy. What are your experiences with extended warranties? I would love to hear your good, bad, and ugly extended warranty experiences!

Until next time…KCMO…Keep Calm and Money On!

Johnathon Brady

The Angry Millionaire